We all know how important it is to teach kids about money, but sometimes it's hard to make it enjoyable. That's where games come in! Games can turn learning about money into a fun adventure, and that's way more exciting than just listening to grown-ups talk about it.

Think of it like this: games are like secret missions where kids get to be in charge of their own money. They can learn how to save up for something special, spend wisely, and even grow their money by investing. It's like learning a superpower, but for money!

These games aren't just about having fun, though. They teach kids essential skills they can use in real life. They'll learn to make a budget, like a plan for their money. They'll also learn about different ways to earn money and how to make smart choices about spending it.

And guess what? Learning about money through games can even help kids feel more confident and in control. They'll start to understand how money works and how they can use it to reach their goals. That's an incredible feeling!

So, if you want to teach your kids about money in a way they'll love, try some fun games. You'll be amazed at how quickly they become little money experts, and they'll have a blast while learning!

Important Things to Remember

- Cash Puzzler: This game helps little kids (ages 3-6) learn about different bills and coins.

- Thinking Money for Kids: This game uses fun activities to teach kids (ages 7-11) about earning, saving, and spending money.

- Budget Game: This game teaches budgeting skills by using real-life examples.

- Stock Market Game: This game shows kids (ages 11-18) how the stock market works and how to invest.

- Fun with Budgeting: This game helps older kids (ages 10-14) learn how to make and stick to a budget.

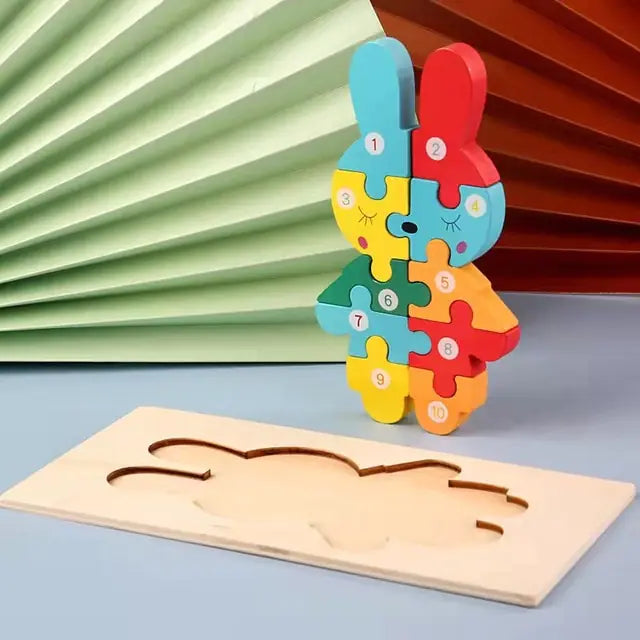

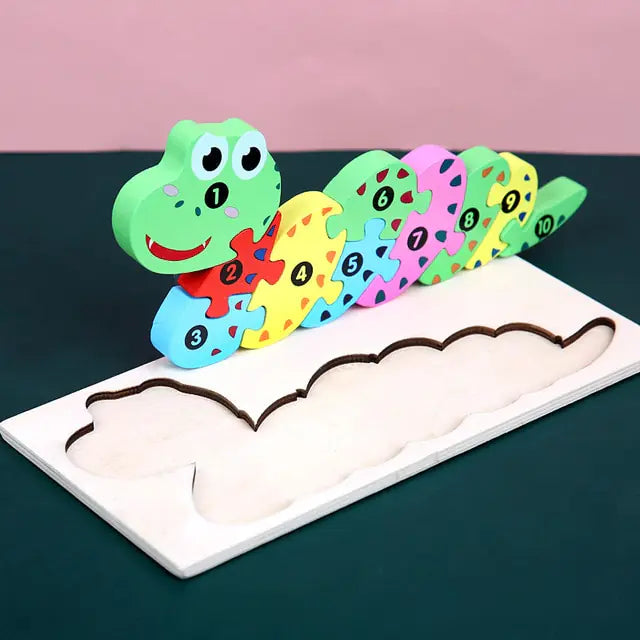

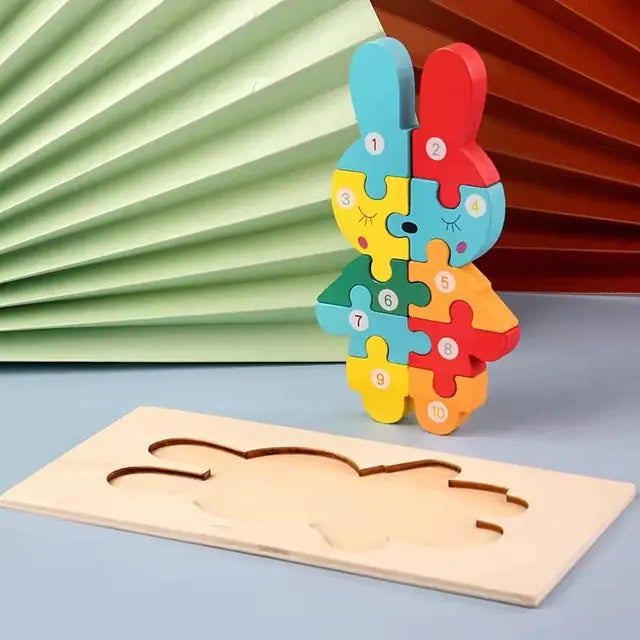

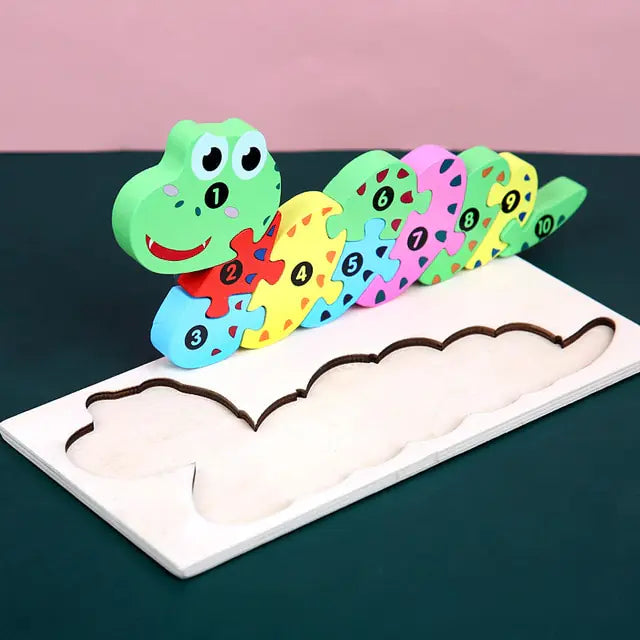

1. Cash Puzzler

Cash Puzzler is a fun puzzle in which kids put together pieces to make a picture of a bill. It's great for kids ages 3-6. They'll learn about different amounts of money and even see which president is on each bill!

Why it's cool:

- Helps with memory: Kids have to remember where the puzzle pieces go.

- Teaches about money: Kids learn about different bills in a fun way.

- Grows with your child: It can be easier or harder to fit your child's age.

2. Thinking Money for Kids

Thinking Money for Kids is an interactive game designed for kids ages 7 to 11. It teaches kids about money through interactive activities. This game used to be available in libraries across the U.S., but it's on hold because of the pandemic. Hopefully, it'll be back soon!

3. Budget Game

The Budget Game is incredible for teaching kids how to use money wisely. They'll learn to budget, decide what to spend money on, and see how much they can save.

What kids will learn:

- How to use money

- How to add and subtract money

- How to make a budget

4. Stock Market Game

Want to teach your older kids (ages 11-18) about investing? The Stock Market Game is perfect! It shows them how the stock market works and lets them try investing with pretend money.

Why it's fantastic:

- Makes kids think: They have to make smart choices about their investments.

- Teaches about risks: Kids learn that investing can be risky.

- Uses real-world skills: They'll use math and reading to play.

5. Fun with Budgeting

Fun with Budgeting is an excellent way for kids ages 10-14 to learn about budgeting. It's like a pretend shopping trip with a set amount of money. They must decide what they can buy and what they need to save for.

How to play:

- Give your child some pretend money.

- Make a shopping list with prices.

- Let them choose what to buy with their budget.

Want to Learn More?

We have a whole budgeting guide on our website that can help you teach your kids about money in a fun way. Check it out!

We've explored some fantastic games that can turn the often-daunting world of finance into an exciting adventure for kids. But remember, these are just a few of the many amazing options out there! There's a whole universe of games designed to teach financial literacy in a fun and engaging way.

The beauty of these games is that they cater to different ages and learning styles. Whether your child is a visual learner who loves puzzles or a kinesthetic learner who thrives on hands-on activities, there's a game out there that will capture their interest and make learning about money a joyful experience.

By incorporating these games into your family time, you're not just teaching financial concepts; you're fostering a positive relationship with money. You're helping your children develop healthy habits and attitudes towards finances that will benefit them throughout their lives.

Imagine the sense of accomplishment your child will feel when they successfully manage their pretend budget in a game or make smart investment choices that lead to virtual profits. These experiences build confidence and empower them to take control of their financial future.

So, don't hesitate! Explore the world of financial literacy games and find the perfect fit for your child. Turn learning into an adventure, and watch as your kids develop the skills and knowledge they need to become financially responsible adults.